Should I Finance My First Car? Why Financing Always Wins

Should I Finance My First Car? Why Financing Always Wins

Posted on April 8, 2021

Being a first time car buyer in Ontario is typically when you hit driving age or if you’re new to Canada. In either situation, your main challenge is going to be raising money to afford the car. With a minimal credit history, you may find it difficult to find an auto loan.

It isn’t impossible though. Where there is a will and with our auto loan team, there is a way! We got them to give us a run down on whether or not you should finance your first ever car purchase?

Financing Your First Car Purchase

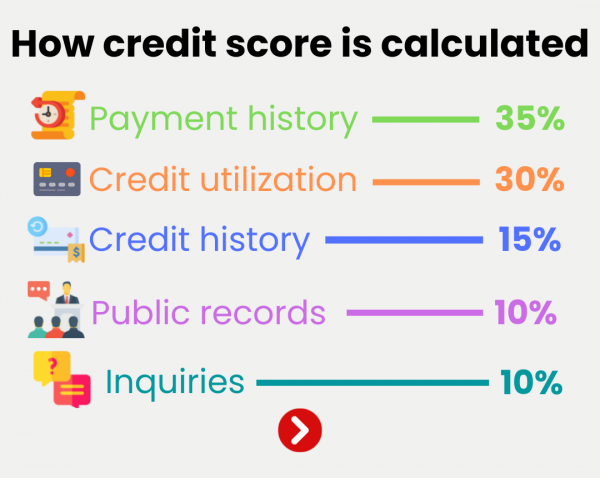

As we mentioned at the top, your main challenge when buying a car is affording one. The vast majority of new cars are bought using auto loans. To qualify for a loan, you’ll need a good credit score, which you may not have.

If you’ve just hit 18, you won’t have had a chance to build up a credit history yet so won’t have much of a score.

If you’re new to Canada, you will have had to leave your old credit history behind and start a fresh one so you won’t have much of a score either.

The good news is that our auto loans team can help both types of buyer.

Your main options are:

Buy a Cheap or Used Car

We would usually recommend this to new drivers as you’re going to ding your car for the first year or two, we all do. If you have been driving a little while, cheap cars still make sense, especially if you’re a student and parking on campus.

Buying cheap or used is also viable for newcomers to Canada. You can buy for cash and use the car while you’re building a credit history. You’re going to need wheels to get you around so this is a viable way to do it.

Check out this list of affordable car options.

Find a Co-Signer if Possible

Depending on who you know and if they are willing to co-sign the loan, you may be able to get help with finance your first car loan. This is perhaps more relevant to new drivers with willing parents or siblings willing to guarantee the auto loan for you.

You ‘own’ the loan and are responsible for paying it. If you default, the co-signer is legally obligated to continue payments or settle the loan.

Newcomers to Canada won’t always have someone to co-sign, but you have other options.

New Immigrant to Canada Programs

Some manufacturers and auto loan companies offer specific programs to help new arrivals in Canada get a car. Some work better in some situations than others but can help you take your first steps in car ownership in our country.

You will need your Canadian Citizenship card and old driver’s licence to get a Canadian licence first though. You may also need supplementary information depending on your country of origin.

We work with new drivers and newcomers here at Unique Chrysler. We have the tools and the expertise to provide affordable finance to people in any situation.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.