Should I Co-Sign a Car Loan? Pros & Cons of Being a Co-Signer

Should I Co-Sign a Car Loan? Pros & Cons of Being a Co-Signer

Posted on January 23, 2023

Have you been asked to co-sign a car loan? Wondering whether it’s a good idea or not? Trying to figure out whether to help out a friend or family member with a car loan? You’re not alone. This is a situation plenty of people find themselves in.

We aren’t going to make your decision for you but we can outline some pros and cons of becoming a co-signer. That way you can make a more informed decision about whether to help out or not.

Co-Signing a Car Loan for Someone

Co-signing a car loan means you guarantee to take over the loan if the primary borrower defaults. It’s a serious financial commitment. While you may never need to worry about it, there are no guarantees in life.

If the past year or so has taught us anything, it’s that life likes to throw a curveball and no matter what position you’re in, nobody is immune from its effects.

So, what are the pros and cons of co-signing a car loan?

Pros of Co-Signing a Car Loan

- Help Someone Out: The main benefit of co-signing is helping out a friend or loved one. It’s something that mainly benefits the other person but should also give you a nice warm feeling inside as you help them out. Also, a lot of people won't able to get approved for a car loan without the help of a co-signer.

- Save Them Money: As a minor benefit, you also help that person save money on interest. Co-signed car loans usually come with a lower rate than might otherwise be possible, which is another benefit.

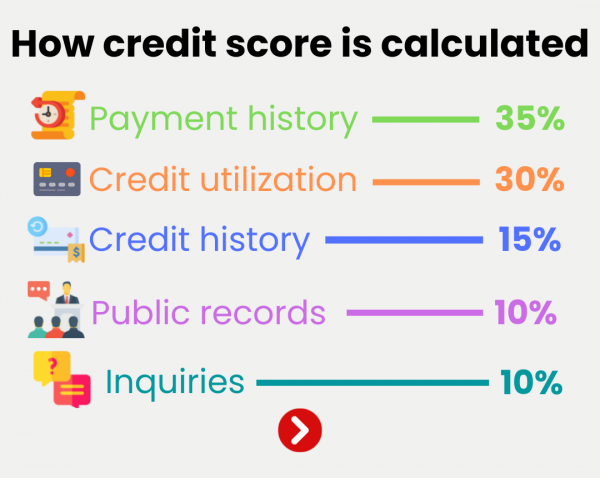

- Builds Your Credit: Someone usually needs a co-signer because they have no credit or poor credit. Helping them get a loan will help them build credit with regular payments. As long as you’re sure they can afford the loan, it’s all good.

Cons of Co-Signing a Car Loan

- You're on the Hook: This is the main downside of a co-signer car loan. If the main borrower gets into trouble or misses a payment, you’re responsible for that payment and perhaps for taking the loan on full time.

- Risking Credit Damage As your name is also on the loan, if the primary borrower defaults, your credit can be hit. If you may the payment on time and no payment is missed, you should avoid that. If you’re not aware they missed a payment, your own credit score could be impacted.

Finances & Family: Mixing family or friends with finance is rarely a good idea. It can work perfectly in some situations but you will never know until you try it. Then it could be too late. Most of us are warned to never mix money and family or friends for good reason.

Being a co-signer on a car loan with someone is ofcourse a little different than lending someone money, but keep in mind there are still risks involved.

There is no right or wrong answer when thinking of co-signing a car loan. Much will depend on the personalities and situations involved. Also, how much you trust the person you’re co-signing with to hold up their end of the deal.

That’s something only you can decide!

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval