Low Interest Car Loans: Can You Still Get One in Ontario?

Low Interest Car Loans: Can You Still Get One in Ontario?

Posted on April 10, 2024

The prices of new and used vehicles are climbing fast in Canada. While interest rates are low enough to make buying a new vehicle affordable, rates are poised to rise soon which could price you out of the new car market. Which means the time to finance a low-interest car loan is now!

Interest Rates, Car Payments, & You

If you had two car loans, one at 5% and the other at 10%, you would naturally want the 5% loan. You wouldn’t be overly upset with the 10% loan because that is more competitive than what credit cards are currently charging.

Did you know that the prime interest rate in Canada is 2.45%, so with a 5% car loan you would be paying 2.5% more than prime?

That doesn’t sound like much but what if I told you that you would be paying double the price in interest, that would catch your attention!

Interest rates impact how much your monthly payment is, if the payment is too high then you will not be able to buy the car.

Qualifying for a Low-Interest Car Loan

Lenders are very cautious, so if you want to qualify for the lowest car interest rates, you need a credit score over 700. You may be able to get a loan approved with a 680 but we want to err on the side of caution.

Having The Right Mix of Credit Products

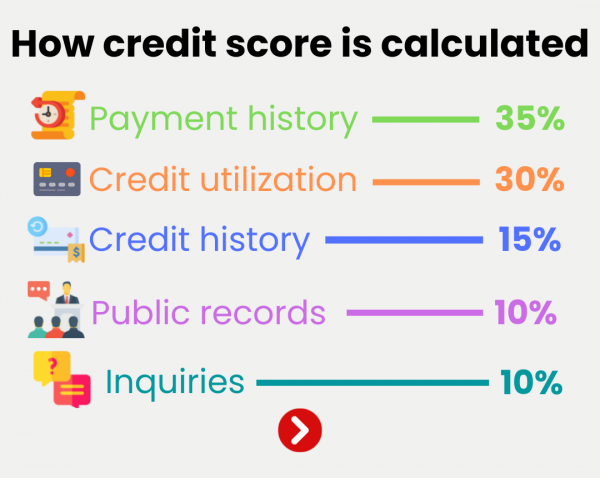

If your credit score falls below 700, it could be due to a lack of active tradelines. The types of credit you have will impact your score if you have only credit cards, which are revolving lines of credit your score will be impacted because you do not have an installment loan.

You may not think this is a big deal, but the mix of credit products can impact your score by as much as 30%!

Are You a New or Used Car?

The type of vehicle you purchase will impact the interest rate you are charged. New cars are eligible for the lowest-interest car loans because the manufacturers offer in-house financing.

There is a limited number of lenders that offer low-interest car loans for used cars. Since the number of used car loans is smaller than new cars, lenders have to charge a higher interest rate to cover their overhead. Click here to learn more about buying a new vs. used car.

Getting The Best Low-Interest Car Loan Possible

It may sound out of place with everyone shopping online but going to a local brick-and-mortar car dealership is the best way to get a competitive car loan. The car dealership has a robust network of lenders and can get you approved for a loan, even if other lenders have rejected your application.

Not only can the dealerships get you approved for a car loan, but they also have cars you can buy right away! This is great news given the shortage of cars in the Canadian market.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval