How To Get Approved For a Car Loan: 6 Must-Know Tips

How To Get Approved For a Car Loan: 6 Must-Know Tips

Posted on January 16, 2023

Have you ever dreamt of cruising down the scenic routes of Canada in your dream car? The key to turning that dream into reality often lies in securing a car loan.

In this guide, we will delve into the essential steps you need to take to ensure a smooth journey toward getting approved for a car loan in Canada.

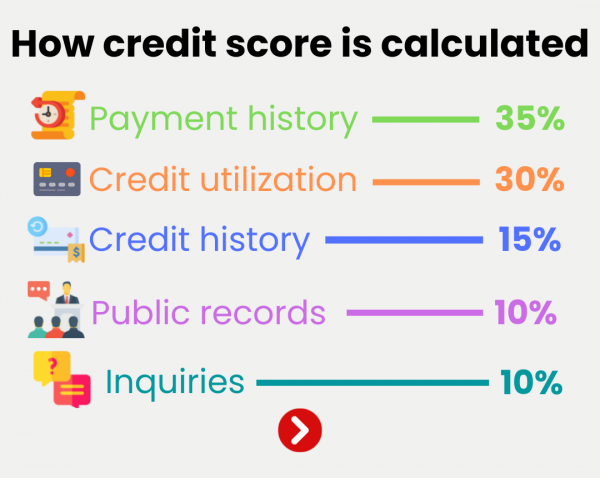

Understanding Your Credit Score

Your credit score is the compass that guides lenders in determining your creditworthiness. It's crucial to begin by understanding your credit score and how it influences your loan approval.

Keep in mind that lenders are likely to approve loans for individuals with higher credit scores, reflecting a reliable credit history.

Setting a Realistic Budget

Before embarking on your car loan journey, it's vital to set a realistic budget. Calculate your monthly income, expenses, and other financial obligations to determine the amount you can comfortably allocate to a car payment.

This step not only aids in securing approval but also ensures that you don't find yourself in a financial bind later on.

Building a Steady Employment History

Lenders appreciate stability, and a steady employment history significantly improves your chances of getting approved for a car loan.

Demonstrating a consistent source of income assures lenders that you are capable of meeting your financial obligations, making you a more appealing candidate for loan approval.

Saving for a Down Payment

A down payment not only reduces the overall amount you need to borrow but also showcases your commitment to the investment.

Saving for a substantial down payment can enhance your chances of approval, as it demonstrates financial responsibility and lowers the risk for lenders.

Exploring Loan Options

In the diverse landscape of car loans, it's essential to explore different loan options available in Canada. Certain lenders specialize in catering to individuals with varying credit profiles, offering customized solutions that suit your needs.

Don't be afraid to inquire about the terms, interest rates, and repayment plans to find the best fit for your financial situation.

Staying Informed About Interest Rates

Interest rates play a pivotal role in determining the total cost of your car loan. Stay informed about the current interest rates in the market and be prepared to negotiate for a favorable rate.

A lower interest rate not only reduces your monthly payments but also makes the overall loan more affordable.

Your Journey Starts Here

Embarking on the journey to secure a car loan in Canada may seem daunting, but by understanding your credit, setting a realistic budget, maintaining a steady employment history, saving for a down payment, exploring loan options, and staying informed about interest rates, you can significantly improve your chances of approval.

Remember, the road to approval may have its twists and turns, but with careful planning and diligence, you can confidently drive toward making your dream car a reality. Safe travels!

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval