Car Loans For Young Ontario Drivers: What You Should Know

Car Loans For Young Ontario Drivers: What You Should Know

Posted on October 15, 2024

Congratulations! You're finally ready to get your own set of wheels. We are so grateful to be able to help you on that journey, but there are a few things we think you should know before diving in head first.

It's more than possible for you to get approved for car financing, but since you're new to the process and young there are some things you should keep in mind. We're going to show you where to start and make sure you feel confident heading into your first car loan. Let's do it!

You Need to Be Over 18

Even if you have a G or G2 license, you must wait until you are 18 to apply for a young driver's car loan. The same is true for all types of credit, including credit cards, car leases, and particularly auto loans.

That implies that you might have to wait until you are of legal age before applying for a car loan. Nothing prevents you from paying cash for a car or using your parents' bank, but you cannot finance it yourself.

Consider a Co-Borrower

A co-borrower can help you raise your credit score once you're over 18 and working on it. Although a partner is typically used, you are free to borrow with a sibling, parent, or anybody else.

You both sign the loan contract and are accountable for it, so pick carefully. Click here to learn more about co-borrowers.

Consider a Co-Signer

If you can't find a co-borrower, a co-signer will work too. Someone else signs the auto loan application on your behalf, promising to take over if you fall behind on payments.

While parents typically perform this job, anyone you trust and who has enough faith in you can take it on. Click here to learn more about co-signing a car loan in Canada.

Can You Afford a Car Loan as a Young Driver?

Paying for the car is only one expense that car ownership brings. There’s also gas, insurance, running costs, servicing, tires, and other expenses too.

When you’re wondering whether to sign up for a car loan or not, make sure to factor the running costs into the equation. Otherwise, you could end up in financial trouble!

Overcoming Stereotypes

Due to their young age, people under the age of 25 are thought to be at higher risk. Young individuals are thought to be inexperienced and more likely to make mistakes, not take responsibilities seriously, and not be excellent borrowers, yet this generalization may be incorrect.

You will have to work hard to prove otherwise by holding down a steady job or providing other income and demonstrating regular payments for rent, a phone, or student loans.

Do You Need to Buy a Car?

As a young driver, you might be able to afford vehicle loans, but do you really want to? Could you live with forgoing weekend plans to save money for a car payment? Could you live without taking a vacation for a year due to car costs?

Although it is a problem we all face, it isn't often taken into account when one is first getting started. You're in luck if the response is yes!

Do You Want Debt?

Debt is incredibly simple to acquire but difficult to control. If this is your first loan, you must ensure that you are prepared for the commitment.

Would you like a sizable amount of your monthly salary to vanish before your eyes? Can you envision what you'll be doing after your loan expires in two or three years?

Just so we're clear. Having debt isn't necessarily a bad thing. Paying off your debt in a timely fashion is how you build credit and show lender's you're trustworthy. Plus, it makes life easier (as long as you don't miss any payments!)

Building Credit

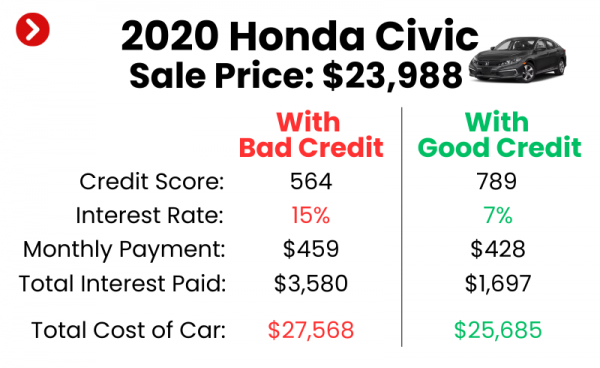

Unless you have had a loan or credit card before, you will be a complete unknown to lenders. You don’t have a credit history, you won’t have a high credit score and you will initially be regarded as high risk. This doesn't mean car loans for young driver's aren't possible though!

Everyone will eventually have to deal with this, but you should keep it in mind while applying for a car loan. You'll pay a lot of interest while you wait to pay off the loan, but it will help you establish credit in the interim!

Thanks so much for reading. Our team of experienced and friendly professionals have specialized in providing locals with affordable auto loans in great quality pre-owned cars for many years. We'd love to help you get approved for a car loan as a young driver. Click here to get started.