Do Car Loans Build Credit Score? All Your Questions Answered

Do Car Loans Build Credit Score? All Your Questions Answered

Posted on January 2, 2024

Have you ever wondered if taking out a car loan can actually boost your credit score? It's a question many Canadians grapple with as they navigate the complex world of credit.

In this article, we will delve into the intricacies of car loans and how they contribute to building, or possibly damaging, your credit.

Understanding Credit Scores

Before we explore the relationship between car loans and credit, let's establish a fundamental understanding of credit scores.

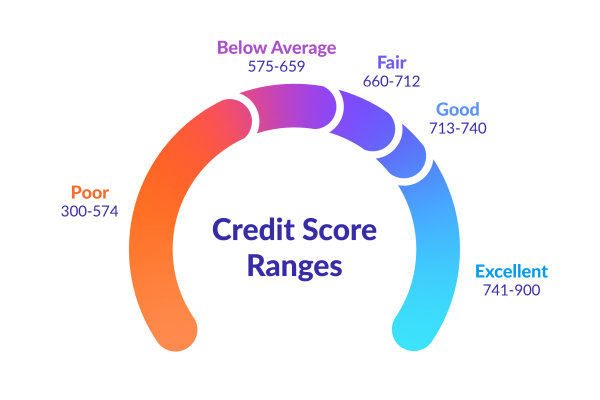

Your credit score is a numerical representation of your creditworthiness, ranging from 300 to 900 in Canada. A higher score typically signifies a lower credit risk, making you more attractive to lenders.

The Connection Between Car Loans and Credit

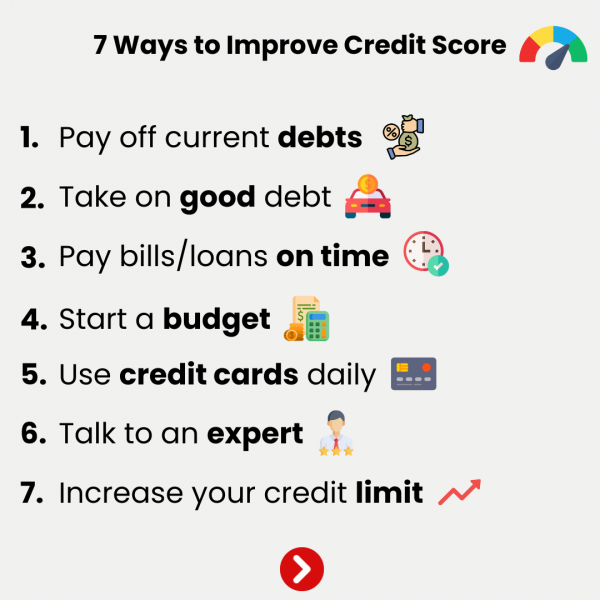

Now, let's address the burning question: do car loans build credit? The simple answer is yes, they can. When you take out a car loan and make regular, on-time payments, you demonstrate responsible financial behavior.

This positive payment history is reported to credit bureaus, influencing your credit score positively over time.

The Impact of Timely Payments

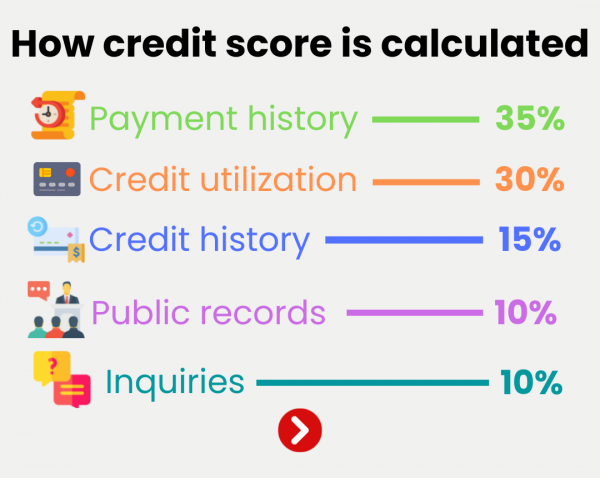

Timely payments play a crucial role in determining the impact of a car loan on your credit score. Each punctual payment contributes to the establishment of a positive credit history.

Your ability to meet your financial obligations reflects positively on your creditworthiness, potentially opening doors to more favorable lending terms in the future.

Loan Diversity and Credit Mix

Credit scoring models consider the diversity of your credit accounts as a factor in determining your credit score. Having a mix of installment loans, like car loans, and revolving credit, such as credit cards, can positively influence your credit score.

This diversity demonstrates your ability to manage different types of credit responsibly.

Potential Pitfalls and Late Payments

While car loans have the potential to build credit, it's crucial to acknowledge the risks associated with late or missed payments. Any negative entries, such as late payments or defaults, can significantly impact your credit score adversely.

It's imperative to adhere to the agreed-upon payment schedule to reap the benefits of a positive credit impact.

Monitoring Your Credit Report

To fully understand the impact of your car loan on your credit, regularly monitor your credit report. Check for any inaccuracies and ensure that your loan information is accurately reflected.

This proactive approach allows you to address any issues promptly and maintain a healthy credit profile.

Start Building Your Credit Today

In conclusion, car loans can indeed build credit when managed responsibly. Making on-time payments and maintaining a diverse credit mix contribute to a positive credit history.

However, it's essential to approach car loans with diligence, as late payments can have adverse effects on your credit score.

By understanding the nuances of this relationship, you can navigate the world of credit with confidence and make informed financial decisions.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval