Car Loan Declined: What Happened & What To Do Next

Car Loan Declined: What Happened & What To Do Next

Posted on January 9, 2024

Have you ever found yourself eagerly anticipating the moment when you drive off the dealership lot in your dream car, only to be hit with the unexpected news of a car loan declined?

It's a disheartening experience that many Canadians face, leaving them wondering why their dreams of car ownership have been abruptly halted.

Reasons You May Have Been Denied a Car Loan

When faced with a declined car loan, it's essential to grasp the reasons behind such a decision. Lenders evaluate multiple factors before approving a loan, including your credit history, income stability, and debt-to-income ratio.

If any of these elements fall short of the lender's criteria, your car loan application might be declined.

Your Credit Score is Too Low

One of the primary culprits behind a car loan declined is often bad or no credit score. Lenders rely heavily on your credit score to assess your financial responsibility.

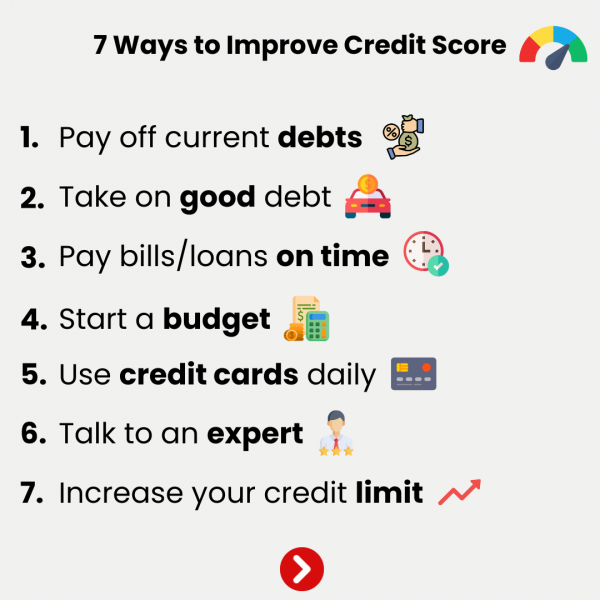

A low credit score indicates a higher risk for the lender, making them hesitant to extend a loan. If you find yourself in this situation, it's a good idea to address and improve your credit before attempting another car loan application.

On the bright side, financing a car loan is one of the best ways to build your credit score, as you'll consistently be paying it off in monthly or bi-weekly increments. Click here to learn more.

Income Instability

Another common reason for a car loan declined is an unstable income. Lenders need assurance that you can meet your monthly payments without jeopardizing your financial stability. If your income is irregular or insufficient, lenders may deem you a risky borrower, leading to a rejection.

Some folks also might find it a challenge to prove income, especially if you're self employed, working seasonally, or working a job like being an Uber driver.

Debt-to-Income Dilemma

Your debt-to-income ratio is a critical factor in determining your ability to handle additional debt.

If you already have a substantial amount of debt relative to your income, lenders may fear that you won't be able to manage the additional financial burden of a car loan. This imbalance can result in the unfortunate news of a car loan declined.

What to do Next

If you've faced the disappointment of a car loan declined, all hope is not lost. Begin by thoroughly understanding the reasons behind the rejection. Once identified, work diligently to rectify the issues.

This might involve improving your credit score, stabilizing your income, or reducing existing debts. Taking these proactive steps will not only increase your chances of loan approval in the future but also demonstrate to lenders your commitment to responsible financial management.

Seeking Professional Guidance

Navigating the complex landscape of car loans can be challenging, especially after facing a rejection. Consider seeking professional advice to better understand your financial situation and explore alternative options.

Financial advisors can provide valuable insights and guidance on how to strengthen your financial profile and increase your chances of loan approval.

Don't Give up!

Experiencing a declined car loan can be a setback, but it's crucial to view it as an opportunity for improvement. By addressing the underlying issues, Canadians can enhance their financial standing and eventually realize their dream of owning a car.

Remember, the road to car ownership may have its bumps, but with determination and strategic financial planning, success is not far off.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval