Can I Have a Mortgage & Car Loan At The Same Time In Canada?

Can I Have a Mortgage & Car Loan At The Same Time In Canada?

Posted on January 3, 2024

One of our other auto loans teams fielded this question from a customer the other day. It was one of those questions interesting enough to write a blog post about. The question was ‘I have 4 years left on a car loan, so can I still qualify for a mortgage while paying a car loan?’

We asked our Brantford auto loans team to offer their take on auto loans and mortgages. This is what they came up with.

Mortgage While Paying a Car Loan

An auto loan and mortgage are probably the two largest debts most of us will pay in our lifetime. Both involve a significant amount of money and both can take quite a while to pay off.

That means they both require some consideration before you commit. Will having an auto loan impact your mortgage application?

Yes, it will, but not always in a negative way.

Affordability

You know that affordability is a key test you have to pass to qualify for an auto loan right? It’s the same for a mortgage.

It’s why you have to prove your income and outgoings and show that you can afford the repayments over the term of the mortgage.

Your auto loan payments will factor into that. The monthly payment will be part of your outgoings and will be removed from your available income to use for the mortgage.

It shouldn’t stop you getting a mortgage. If you’re paying rent or a mortgage now and the amounts are similar, you should already be proving affordability!

Debt-to-Income Ratio

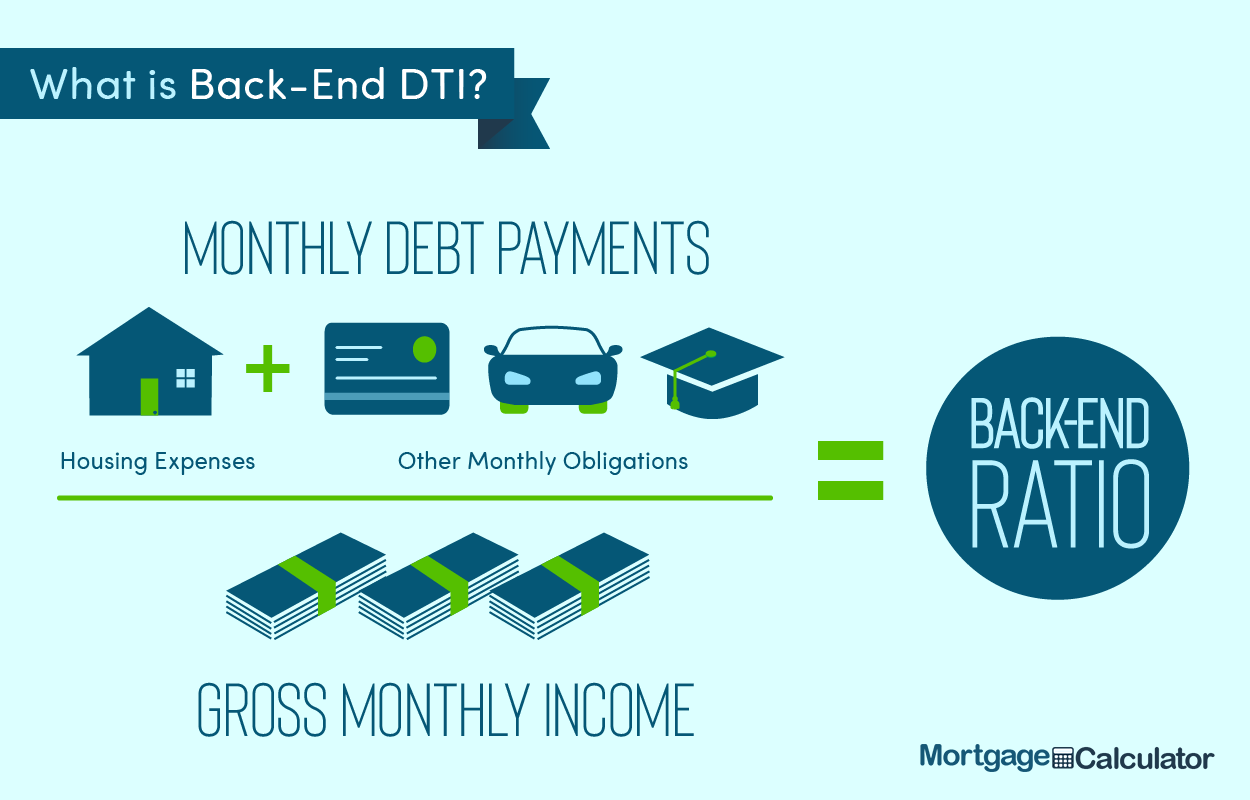

Debt to income ratio is how much of your monthly income is taken up by servicing debt. It is factored into any lending decision, including auto loans and mortgages.

As it’s a ratio, it uses a percentage. The ‘ideal’ percentage for lenders is less than 35% for auto loans and less than 45% for mortgages.

Let’s use an example to illustrate. Say, you pay $1000 a month on rent, $400 on your car loan and $100 on all your credit cards. This comes to $1500 per month.

In the example, you earn $4,500 per month. Divide that by $1500 to give you 33%. This is your debt to income ratio.

If you were applying for an auto loan, you would be close to the mark. As you’re looking at a mortgage, you’re fine.

Payment History

Your payment history factors into every lending decision you’re part of and will definitely play a part in any mortgage decision.

As you’re paying off a loan, you should have a good payment history. If you have never missed a payment, you should have a spotless payment history, which a mortgage lender will view favourably.

If you have missed auto loan payments or other payments, any lender will look very carefully at your application. It won’t necessarily prevent you getting the mortgage but you may have some explaining to do…

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.