Buying a Car With Bad Credit: Get Approved in No Time

Buying a Car With Bad Credit: Get Approved in No Time

Posted on January 15, 2024

Picture this: you're cruising down the open road, wind in your hair, and the freedom of the open highway at your fingertips. Owning a car is not just a means of transportation; it's a symbol of independence and possibility.

However, what happens when bad credit threatens to put the brakes on your dreams?

Fear not, Canadian readers, because in this article, we will explore how you can overcome the obstacles of bad credit and still drive away with the car of your dreams.

Understanding Bad Credit

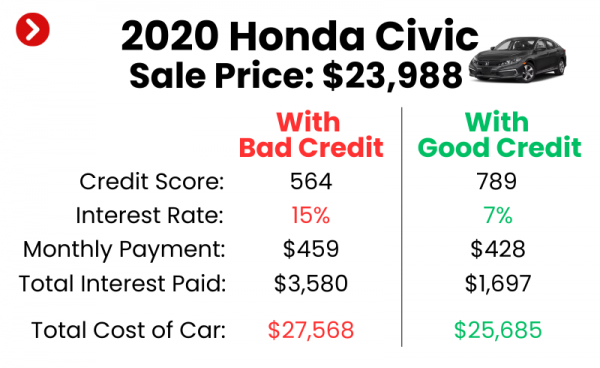

Before diving into the process of buying a car with bad credit, it's essential to understand what bad credit entails. In Canada, credit scores typically range from 300 to 900. A credit score below 600 is generally considered poor or bad credit.

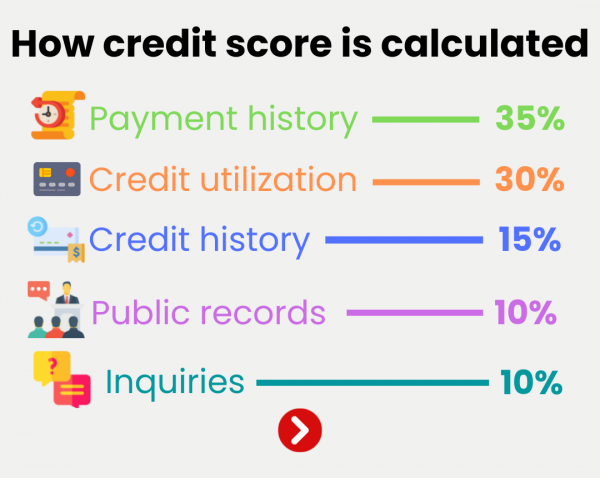

Factors such as missed payments, high credit card balances, and a history of bankruptcy can all contribute to a low credit score.

Knowing where you stand is the first step in overcoming the challenges associated with bad credit.

Assessing Your Financial Situation

Once you understand your credit situation, it's time to assess your overall financial health. Take a close look at your income, expenses, and existing debts. Create a realistic budget that allows you to determine how much you can afford to spend on a car loan each month.

Remember to factor in additional costs such as insurance, maintenance, and fuel.

Being aware of your financial limitations will help you make informed decisions during the car buying process.

Building a Down Payment

Saving up for a down payment can significantly improve your chances of getting approved for a car loan with bad credit. A larger down payment demonstrates your commitment and lowers the risk for lenders.

Allocate a portion of your monthly budget towards saving, and consider cutting back on non-essential expenses to expedite the process. Aim for a down payment of at least 10% of the vehicle's purchase price to increase your approval odds.

Pre-Approval Process

Getting pre-approved for a car loan is a smart move before heading to the dealership. It allows you to understand your loan options and budget for a car within your means.

While interest rates may be higher with bad credit, obtaining pre-approval enables you to negotiate better terms and potentially secure a more favorable loan.

Building and Rebuilding Credit

Buying a car with bad credit shouldn't be seen as a final destination. It's an opportunity to rebuild and improve your credit score. Paying your car loan on time and in full each month will demonstrate financial responsibility.

Over time, this positive payment history will help increase your credit score, opening doors to better financing options in the future.

Protecting Your Investment

Once you've successfully purchased a car, it's important to protect your investment. Maintain a strong credit score by practicing good financial habits. Make timely payments, keep credit card balances low, and avoid taking on unnecessary debt.

Protecting your credit will ensure that you continue to enjoy the benefits of car ownership and pave the way for future financial opportunities.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval