Can I Buy a Car With No Credit Score In Ontario?

Can I Buy a Car With No Credit Score In Ontario?

Posted on January 5, 2024

If you’re new to Canada, a student or haven’t had credit before, you won’t have much of a credit history.

This can provide something of a challenge when you come round to applying for an auto loan. So, can you buy a car with no credit and what are your options?

Why Your Credit Score Matters

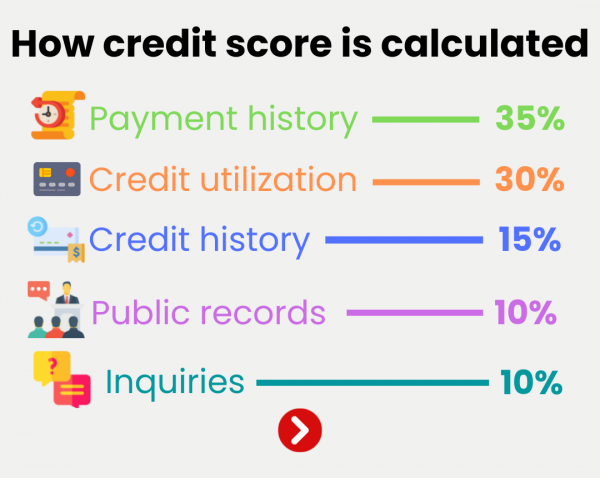

Your credit history is an outline of how you manage credit. Banks and auto loan companies don’t know you. They don’t know how good with money you might be or how high, or low, a risk you are for lending.

All they have to go on is how you have dealt with debt in the past using your credit history.

If you don’t have a credit history, you’re an unknown quantity. All those markers lenders would normally use to assess risk are not there.

You might think that living life so far without requiring credit is evidence enough that you’re good with money. In many situations it is. But when you’re looking for a auto loan approval, or any type of loan, it isn’t.

If a lender cannot gauge how much of a financial risk you might be, they will find it harder to lend to you.

Hard, But Not Impossible

We said lenders would find it harder to lend to you, but we didn’t say they wouldn’t lend to you. Some local dealers like us specialize in helping those struggling with low credit get approved.

Some local dealers like us in Ontario specialize in helping those struggling with low credit get approved. The banks and lenders we send your application to assess your income, your outgoings, whether you can afford the loan or not and a number of other factors to decide your level of risk.

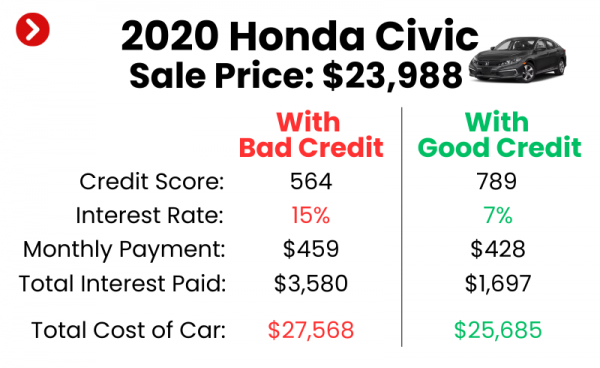

You will likely pay a higher interest rate than someone with an established credit history but you can still get credit.

How to Buy a Car With No Credit Score

There are a couple of things you can do to increase the chances of being accepted for an auto loan with no credit history.

A Larger Down Pyment

A down payment on a car loan as a large amount you pay upfront when making the purchase. It helps keep monthly payments down and loan length down, and increases your likelihood of approval.

The larger your down payment, the more likely you are to get a loan. Down payments insulate lenders from loss so the more money you put down, the more likely you are to get the loan.

Find a Co-Signer if Possible

If you know somebody with a good credit score who would co-sign the loan with you, that can also increase your chances. They are essentially guaranteeing that if you default, they will take over the loan.

Increase Your Credit Score

While less than ideal if you have lived this long without it, building credit is a viable way to increase the chances of an auto loan. Use a credit card, use a secured credit card or even a credit builder card. Pay it off at the end of the month and you begin building credit.

It isn’t impossible to buy a car with no credit score It’s just more difficult than if you had it. Work with the experts and nothing is impossible!

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.